The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article appeared first in The Sustainability Gap, an in-depth analysis of BoF’s new report, The BoF Sustainability Index, which tracks fashion’s progress towards urgent environmental and social transformation. To learn more and download a copy of the report, click here.

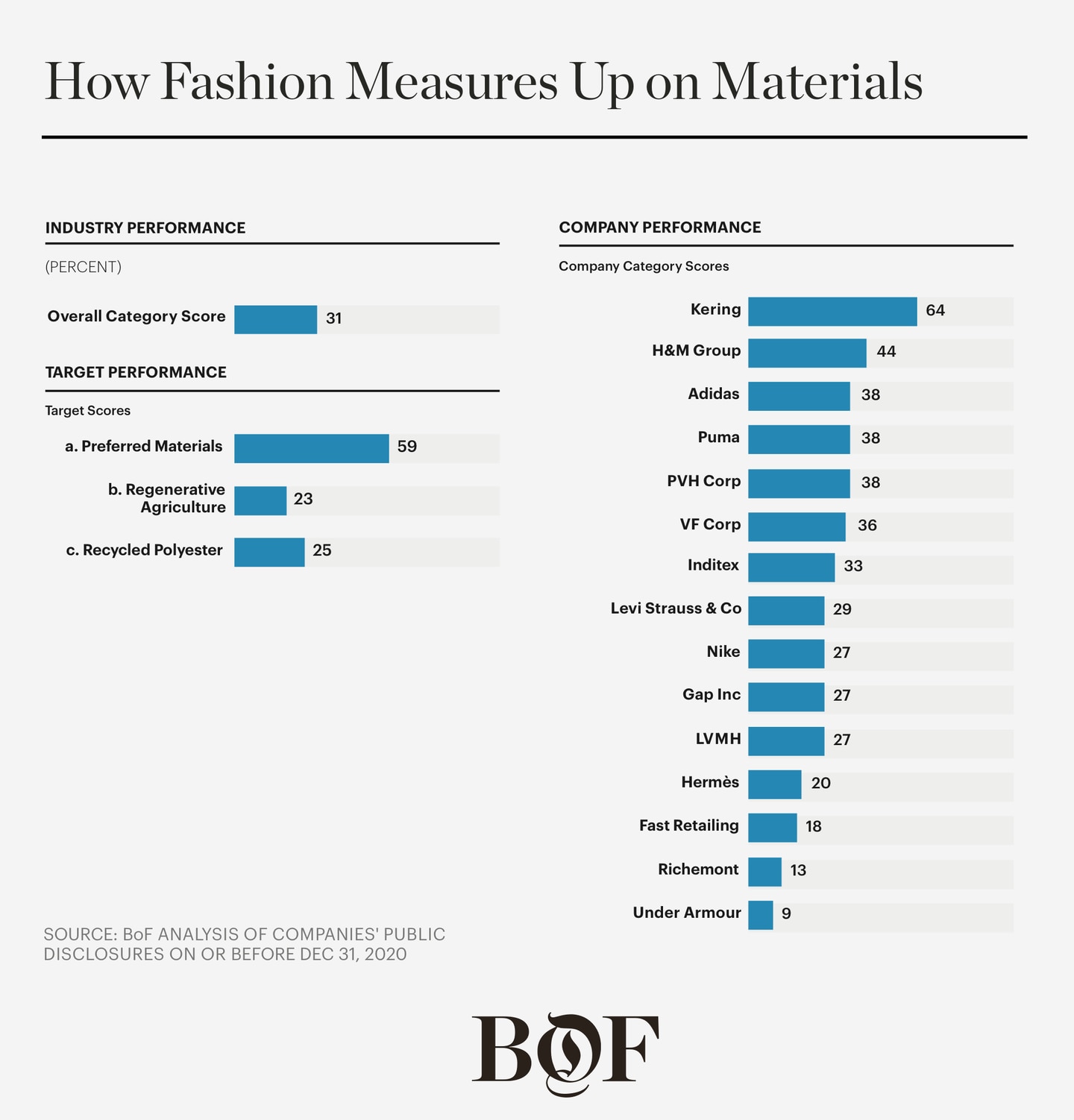

The BoF Sustainability Index Materials Targets:

a. Preferred Materials — By 2022: Procure 100 percent of materials from preferred sources.

b. Regenerative Agriculture — By 2030: Procure 100 percent of all natural fibres from regenerative and socially responsible sources.

c. Recycled Polyester — By 2030: Eliminate virgin polyester.

Most clothes in the world are made using fossil fuels. Oil-based polyester is the most commonly used fabric in the world, with nearly 60 million tonnes produced in 2019. Fashion’s second-favourite fibre is cotton, a product with a complicated environmental footprint whose present links to modern slavery are as problematic as its past.

Shifting the raw material supply chain is both a colossal challenge and immense opportunity. The growing momentum behind more sustainable and regenerative agricultural practices holds out the prospect to not only mitigate fashion’s footprint, but perhaps one day enable the industry to have a net positive impact.

Materials certified to have a better environmental and social impact have hit the mainstream.

Data to quantify the impact of the shift to more sustainable materials is limited.

Raw material supply chains remain a dangerous blind spot.

Eliminating virgin polyester will be a long and difficult task.

Regenerative agriculture is attracting growing attention.

The Sustainability Council’s Take

“A transition away from fashion’s current extractive business model would be transformative. But scaling the industry’s access to regeneratively farmed materials and establishing regenerative systems requires investment and commitment. Greater education is required to ensure executives and employees understand the impact of their sourcing choices and are empowered to make better decisions for the planet. Investment is needed to build the capacity of both land stewards (so the risk of shifting ways of working is shared by all stakeholders) and distributed processing infrastructure. Outcome-based data, rather than practice-based commitments, must support any claims of land regeneration. Finally, it will require a transition from obscure and transactional supply chains to transparent and relational value networks.” — Daniela Ibarra-Howell, CEO and Co-Founder, Savory Institute

The BoF Sustainability Index is built on over 5,000 data points gathered across the 15 companies included in this year’s edition. To request access to the full underlying data, click here.

The BoF Professional Summit: Closing Fashion's Sustainability Gap

On April 14 2021, BoF will convene leading sustainability experts and global thought leaders for a 3-hour live broadcast of interactive conversations and panel discussions, in which we'll unpack findings from The BoF Sustainability Index and outline the steps that need to be taken over the coming decade to align the industry with global climate goals and social imperatives. Space is limited.

As a BoF Professional member, register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professional membership, including the Summit.

Explore all categories from this year's report:

The BoF Sustainability Index is based on a binary assessment that examines companies’ public disclosures up until December 31, 2020. There are limitations to this approach and while the assessment was conducted in good faith, the results should be viewed as a proxy for sustainability performance and not an absolute measure. Where BoF was unable to identify public evidence to support a company’s performance relating to the assessment criteria, it does not necessarily mean the company is taking no action at all or that bad practices are present. Read the full methodology on pages 38-41 in the report here or see the FAQs.

Disclaimer: LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.