The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Consumer demand for sustainability is at an all-time high and isn’t going anywhere anytime soon. A recent survey of American consumers by Boston Consulting Group found that 75 percent view sustainability as “important” or “very important” with more than one-third reporting they have at some point switched from their preferred brand to a more environmentally friendly alternative. And far from diminishing amid the pandemic, environmental concern is actually on the rise. Seventy percent of respondents are now more aware that our climate is affected by human activity than they were before the crisis began.

But if shoppers are increasingly cognisant of the ecological costs of their purchases, rising to the challenge is easier said than done for the brands targeting them.

Despite growing consumer demand for sustainable goods, it's not always clear what consumers are actually demanding. Sustainability remains a nebulous concept that means different things to different people and continues to shift as a priority over time. Many consumers struggle to identify what makes a brand or product sustainable to begin with. Some are unwilling to pay a higher price.

Sustainability matters to consumers, but not at a premium.

Fashion companies have their work cut out for them. They must address an increasing (albeit uneven) demand for sustainability, while also delivering products their customers want to buy. In order to be successful, brands will have to better understand what matters most to consumers, and just as importantly, empower and incentivise them to shop sustainably.

What Is Sustainability Anyway?

This is a seemingly simple but rather complex question whose answer lies in the eyes of the consumer, whose own interpretation might differ from her peers and will likely evolve over time.

Mounting fears of global warming — and, more recently, the pandemic — are contributing to the growing demand for sustainable products. For example, the past few years have brought an increased public interest in water conservation and climate impact. These concerns now receive as much attention as recycling and waste reduction, long-time hallmarks in the broader conversation on safeguarding the environment.

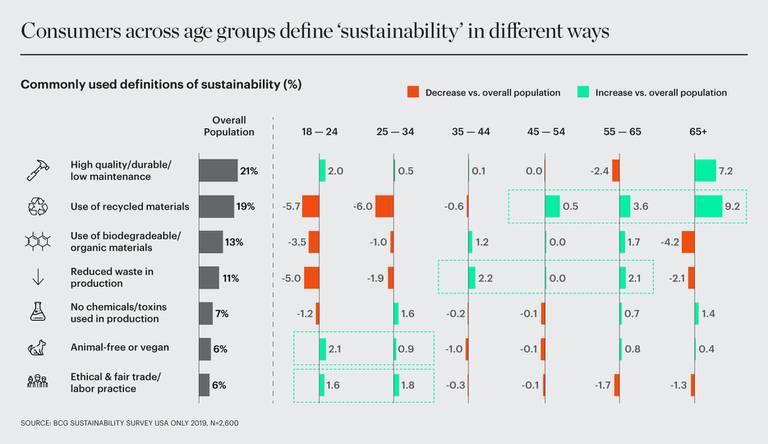

And though consumers worldwide most commonly define sustainability in terms of materials usage and production processes, from there, the disparity in their views is striking. Definitions vary across product categories and market segments, particularly by age and nationality.

The under-35 population, for example, factors labour practices and the use of animal products into the equation, placing additional hurdles for brands to clear in order to meet customer expectations. While younger cohorts place greater emphasis on animal-free and vegan-made products, as well as ethical trade and durability, senior cohorts remain focused on recycled goods and waste reduction.

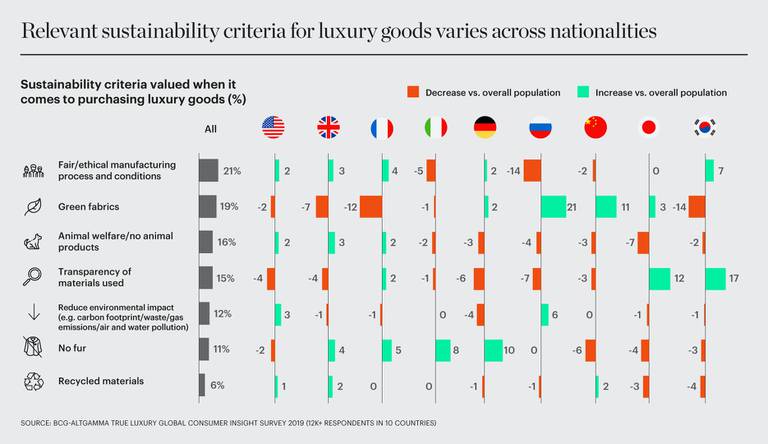

Such variation makes it harder for brands to meet the full range of expectations. The challenge is even greater for global luxury goods companies, for whose consumers the concept of sustainability varies by nationality.

Our research suggests a wide disparity in what matters most to consumers when shopping for luxury goods, with shoppers from China and Russia placing greater value on green fabrics, for instance, and those from Italy and Germany caring more about the use of fur. Compared with the rest of the population, South Koreans are more concerned with material transparency and the French with fair labour conditions. Ultimately, luxury consumers around the globe are demanding sustainability, but they do not always agree on what it looks like.

Sustainability Matters, But…

Just because sustainability is important to consumers doesn’t mean they feel sufficiently empowered — or even willing — to shop sustainably. Our research shows that a lack of clarity and awareness, as well as perceived higher price points, are the main factors preventing consumers from purchasing sustainable goods. Other barriers include a lack of availability of preferred styles and brands, perceived inconvenience and the belief that a product isn’t truly sustainable.

The challenge for brands is compounded by the fact that overcoming these obstacles doesn’t guarantee more sales. Despite their demand for sustainability, the average consumer still places emphasis on other factors — such as value, quality, durability and style — when deciding to pull out their wallets. This is true across the market; consumers obviously weigh criteria differently when shopping for socks than for a new watch, but as it turns out, sustainability doesn’t rank as highly as other factors in either case.

The lesson for brands is clear: sustainability matters to consumers, but not at a premium, and certainly less than other functional, immediately felt concerns.

Nevertheless, in the wake of the current crisis, each of us has become increasingly aware of the impact our choices have on the world around us, both immediately and in the longer term.

In addition to sparking increased environmental concern among consumers, the pandemic has also forced many businesses to expand their commitment to sustainability, specifically with regards to their production processes and supply chains. We’ve also seen an uptick in the hiring of chief sustainability officers and in eco-friendly initiatives.

Brands should capitalise on this momentum to help bring about a more sustainable future and because we believe that companies who do not invest in sustainability will find themselves at a cost disadvantage in the long term.

How Brands Can Rise To the Challenge

Consumer demand for sustainability poses a tough but surmountable obstacle for fashion. The good news for brands is that they can continue to pave the way for more sustainable practices within and beyond the industry. To remain competitive in the years ahead, companies should embark on the following four steps — and learn from those already leading the charge:

Sarah Willersdorf is a Partner & Managing Director in Boston Consulting Group’s New York office and Global Head of Luxury. Robbin Mitchell is a Managing Director & Partner in Boston Consulting Group’s New York office.

The views expressed in Op-Ed pieces are those of the author and do not necessarily reflect the views of The Business of Fashion.

How to submit an Op-Ed: The Business of Fashion accepts opinion articles on a wide range of topics. The suggested length is 700-1000 words, but submissions of any length within reason will be considered. All submissions must be original and exclusive to BoF. Submissions may be sent to opinion@businessoffashion.com. Please include 'Op-Ed' in the subject line and be sure to substantiate all assertions. Given the volume of submissions we receive, we regret that we are unable to respond in the event that an article is not selected for publication.

Related Articles:

[ How to Make Sustainable Fashion People Will Actually Buy ]